In his first budget the Chancellor of the Exchequer had the opportunity to set a course for Britain’s prosperity post Brexit and to help Mrs May achieve her goal of making Britain a country that works for everyone, while reducing the budget deficit.

Instead the measures he proposed caused a storm of protest. Raising the National Insurance Contributions (NIC) of the self-employed, it was pointed out, would hit hardest those already struggling to make a living, while the revised valuations for Business Rates would drive many small businesses into bankruptcy. This would reduce economic activity, reduce tax revenue and burden the state with the cost of supporting more people, thus widening the deficit. The net effect would be counterproductive.

What might a People’s Budget look like? The first step would be to abolish NIC and the second would be to recoup the revenue lost by reforming the basis on which Business Rates and Council Tax are assessed.

Abolishing NIC would benefit the self employed, not just financially, but would also relieve them of the administrative task of reporting their earnings and calculating the tax due, an unproductive activity. It would relieve employers of a considerable cost of employing people, benefitting especially labour intensive occupations such as public services: nursing, police, military, civil service, catering and others. In fact the government, as an employer, would save millions, not just in tax saved, but in the administrative costs of collecting the tax.

It is true that abolishing NIC would also benefit the rich and well off, but reforming the basis on which Business Rates and Council Tax are assessed would address this by benefitting the poor more than the rich.

Currently property taxes are assessed on the market value of the site and any buildings or improvements. One unfortunate consequence is that the more investment in the site the higher the tax, which acts as a disincentive, when investment is what is needed to drive the economy forward.

The value of the site, on the other hand, is dependent on its location and natural resources, such as fertility and minerals. What they have in common is that their value is not created by the occupant of the site in contradistinction to the improvements which are the product of the work and investment of the owner or occupier of the site. There is, therefore, as Alfred Marshall pointed, out a public and a private component in property values.

Current taxation draws heavily on the private component leaving the public component largely untaxed to accrue as unearned income. Abolishing NIC would leave more earned income in the pockets of workers, reducing the need for tax credits and so tax revenue to support the cost. Reforming the basis of Business Rates and Council Tax would fund more government expenditure out of the public value of the site, reducing the need to tax private income, encouraging investment and the most efficient use of sites.

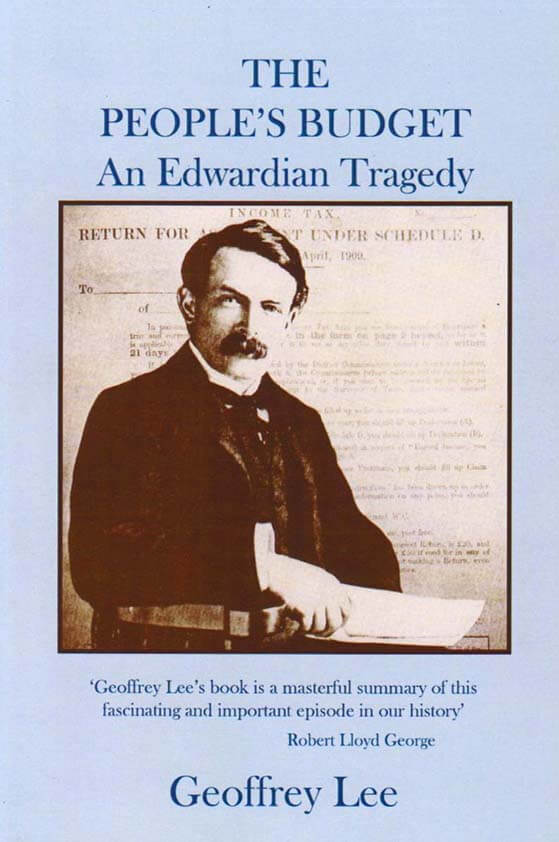

In The People’s Budget Geoffrey Lee describes two attempts made in Britain to move in this direction. The first was by the Liberal Government before the First World War. In his 1909 budget, the “People’s Budget”, Lloyd George included measures to raise extra revenue from the public value of land. This caused a storm of opposition from the House of Lords, then almost exclusively composed of large landowners, who rejected the budget, thereby challenging a convention that the upper house would not block bills of the lower house on matters of finance. The Lords eventually backed down and the Bill was passed, but the outbreak of the First World War put an end to the process of valuation.

The second occasion was in 1931 when a Labour Chancellor included a Land-Value Tax in his budget. With the financial crisis of the same year, the valuation of land was suspended and the measure later repealed.

Were Britain to reform its tax system in this way, abolishing in stages taxes that penalise work, enterprise and investment, such as Income Tax, VAT and Corporation Tax, and instead fund government out of the publicly created value of land, Britain would become a very desirable place for businesses to locate: a post-Brexit Britain which would work for everyone.